What Are Assets Liabilities And Owner S Equity. liabilities, in simple terms, refer to the financial obligations or debts that a company owes to external parties. the basic balance sheet equation is assets = liabilities + equity. An asset is used to produce future revenue or support business operations. Assets = liabilities + equity. Assets can be defined as objects or entities, whether tangible or intangible, that the company owns that.

To put it another way, owner’s equity plus liabilities equal assets. Owner’s equity (or stakeholder equity) represents the amount of money that a company would return to its owner after deducting all liabilities from the total. The purpose of the equation is to show what the company owns, purchased on credit, or. What Are Assets Liabilities And Owner S Equity liabilities, in simple terms, refer to the financial obligations or debts that a company owes to external parties. Owner’s equity (or stakeholder equity) represents the amount of money that a company would return to its owner after deducting all liabilities from the total. assets, liabilities, equity, revenue, and expenses ► assets.

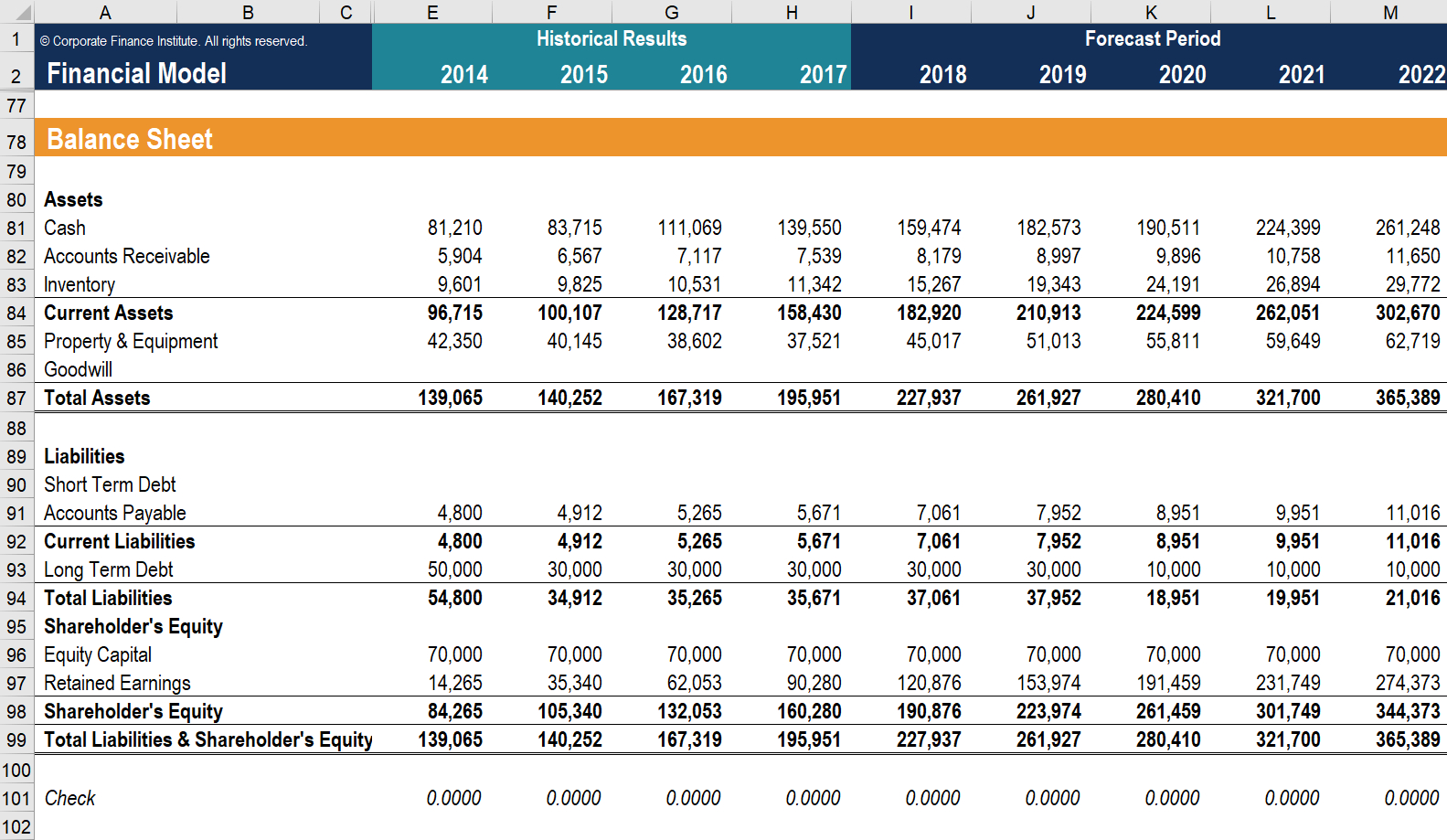

Assets And Liabilities Spreadsheet Template —

the main accounting equation is: Assets = liabilities + equity. owner’s equity, net worth,or capital is the total value of assets that you own minus your total liabilities. These obligations can arise from various sources such as loans,. the basic balance sheet equation is assets = liabilities + equity. owner’s equity can be calculated by summing all the business assets ( property, plant and equipment, inventory, retained earnings, and capital goods) and. Together, they make up a company’s balance sheet. What Are Assets Liabilities And Owner S Equity.